LIC IPO | Life Insurance Corporation of India (LIC) IPO | LIC IPO 2022 |Life Insurance Corporation of India (LIC) | Allotment Status

Table of Contents

About Life Insurance Corporation of India (LIC)

Life Insurance Corporation of India [LIC] is an Indian statutory insurance and investments corporation. It comes under the ownership of the Ministry of Finance, Government of India. The Life Insurance Company of India was established on 1st September 1956, when the parliament of India passed the life insurance of India Act that nationalized the insurance industry in India. Over 245 insurance companies and provident societies were merged to create the state-owned life insurance corporation of India

Life Insurance Corporation of India (LIC) Network

- LIC had 5 zonal offices, 33 divisional offices, and 212 branch offices.

- 2LIC functions with 2048 fully computerized branch offices, 113 divisional offices, 8 zonal offices, 1381 satellite offices, and the corporate office.

- LIC’s Wide Area Network covers 113divisional offices and connects all the branches through a Metro Area Network.

- LIC has tied up with some Banks and Service providers to offer on-line premium collection facilities in selected cities. LIC’s ECS and ATM premium payment facility is an addition to customer convenience. Apart from on-line Kiosks and IVRS, Info Centres have been commissioned at Mumbai, Ahmedabad, Bangalore, Chennai, Hyderabad, Kolkata, New Delhi, Pune, and many other cities.

- In order to provid easy access to its policyholders, LIC has launched its SATELLITE SAMPARK offices. The satellite offices are smaller, leaner, and closer to the customer. The digitalized records of the satellite offices will facilitate anywhere servicing and many other conveniences in the future.

Government Views on Life Insurance Corporation of India (LIC)

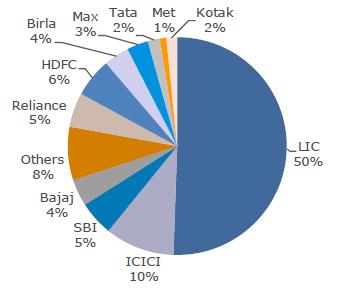

The government is expected to launch the Initial Public Offering [IPO] of the country’s largest insurance Life Insurance Corporation [LIC] in the fourth quarter [Q4] of the ongoing financial year [FY22]. The listing of LIC will be crucial for the government to meet its disinvestments target to fulfill its long-term vision. For this Merchant bankers were appointed by the union government they have been asked to draw up a list of large investors that may act as anchor investors in the initial public offering [IPO] of Life Insurance Corporation of India [LIC]. LIC has a majority share of the life insurance market in India. As illustrated in the image below.

The Life Insurance Corporation of India (LIC) board is expected to meet in the coming week and is likely to submit a draft red herring prospectus (DRHP) to the market regulator, Sebi. The Insurance Regulatory and Development Authority (IRDAI) approved LIC’s proposal on February 9. On the other hand, the board is also expected to discuss likely discounts and the portion to be reserved for policyholders.

LIC IPO: Issue size

The government is planning to offload around 5 percent of the shares it owns in LIC. The embedded value of the company has been estimated at over Rs 5 trillion. The valuation of LIC IPO will be around three to five times the embedded value. The valuation of the mega LIC IPO could be around Rs 15 trillion. The government may sell 316 million shares.

Reserve portion for policyholders

The government of India has announced that up to 10% of the issue size in LIC [IPO] will be reserved for policyholders. A discount on the base price is also expected for this category of investors. To promote the LIC IPO among the policyholder organization already ask the policyholder to update their KYC and link their Pan Card with the Policy and also open a Demat cum trading account in order to participate in the IPO.

Reserve portion for Existing Shareholder in a Subsidiary company

It is also expected that the Government of India and the Board may also reserve some portion of shares to the Existing investor in its subsidiary company such as LIC Housing Finance (LIC HFL), LIC Mutual Fund, etc

LIC IPO Date 2022

| IPO Closing Date | 4th May 2022 |

| IPO Opening Date | 9th May 2022 |

| Issue Type | Book Built Issue IPO |

| Face Value | ₹ 10 per equity share |

| IPO Price | Rs.902 toRs. 949 per equity share |

| Market Lot | 15 shares |

| Min Order Quantity | Rs 13530/15 shares |

| Listing At | BSE, NSE |

| Issue Size | Rs.21,000 Cr. |

LIC IPO Registrar

Some Important Links

- Link Pan Card to Policy- Click Here

- Check Status Pan Card linked to policy-Click Here

- Check Allotment Status-Click Here